PayrollGuru is a premier payroll service provider that offers complete range of payroll processing services to our clents in all 50 states and US territories.

Whether you process payroll in-house or outsource payroll processing to other companies we can provide you with the most efficient payroll solution for this important business task.

We have friendly payroll staff and we utilize software capable of performing any payroll task.

We can reduce your current payroll processing costs by

depending on your current situation.

You will be satisfied with our services, or your money back guaranteed!

Our fully qualified and experienced accountants will help you process payroll for your employees in matter of hours.

By using our services you can improve your typical payroll process and cut expenses associated with the large payroll providers.

Payroll Direct Deposit

Federal and State electronic tax payments

Check printing

Check signing

Elecronic Filing of W2/1099 and quarterly reports

Payroll Register

Employees W2 and 1099/1098/1096 forms

Being a small and lean company allows us to provide

a personal touch to everything we do. You may rest assured

that your payroll needs will be met on time and you will

receive a prompt attention and superb service from our key

personnel. We return your calls and we make it easy for you

to do your payroll.

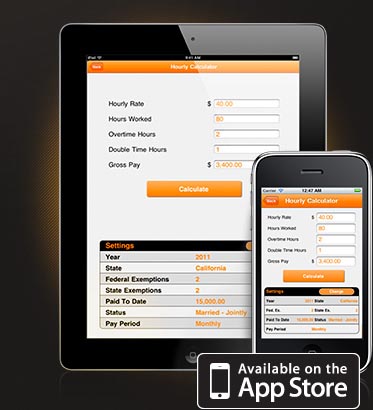

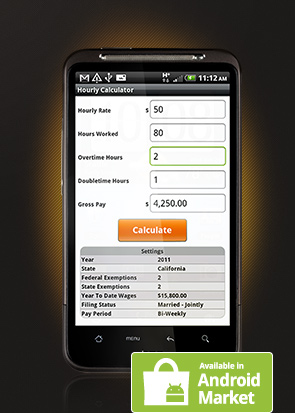

Using our latest technology and tools, you can do your payroll online or on the go, with the help of our mobile payroll apps to get your job done. And if you need to talk to us - our help we will be there for you.

Pay employees, pay taxes,

stay current with the changes in payroll regulations with Payrollguru, Inc.

Please sign and fax the following documents

to 619-800-0729 to start the payroll service for your company:

Direct Deposit Service Application

Reporting Agent Authorization Form

Other documents you may need for your files:

Employee Direct Deposit Authorization FormW-4 Employee Withholding Allowances Form

I-9 Employment Eligibility Verification Form